Last year we wrote a blog on salary vs dividends for business owners, following a flurry of changes in tax and National Insurance. A revolving door of Chancellors and Prime Ministers, a doomed mini-budget and hasty back-track have kept things changing, so we decided to produce an updated version.

Firstly, we recap what has changed and where we currently stand with the main taxes involved before we get to a comparison of salary versus dividends and possible remuneration strategies.

National Insurance

Since our last instalment the ‘Health & Social Care Levy’ – announced 18 months, three Prime Ministers and four Chancellors ago – has been binned and the temporary increase in National Insurance rates for 2022/23 reversed.

The point at which you start paying National Insurance Contributions (NICs) personally (the “primary threshold”) has increased to £12,570 – the same point at which you begin paying income tax.

The point at which your company starts paying NICs (the “secondary threshold”) has been frozen at £175 per week / £9,100 per year.

Income Tax

The Personal Allowance, up to which you don’t pay income tax, remains at £12,570 and the basic rate tax band at £37,700. Both have been frozen until 2028.

The point at which you begin losing your personal allowance remains at £100k – as it has since 2010. For every £2 your income exceeds £100k, your personal allowance will be reduced by £1 until it is entirely lost. This creates very high effective rates of tax on earnings between £100k and £125,140.

The point at which you pay additional rate tax (45%) has been reduced from £150k to £125,140 of income.

Income tax on dividends remains the same as in 2022/23 and didn’t receive the reversal in rates that NICs enjoyed. The dividend allowance, on which you pay tax at 0%, has been reduced to £1,000 (from £2,000). It will be reduced again next tax year to £500.

Corporation Tax

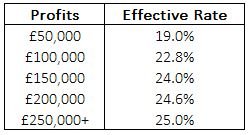

The big change for this tax year; the main rate of Corporation Tax increased to 25% from 1st April 2023, up from 19%. A small profits rate of tax will be reintroduced, keeping the 19% rate for companies with profits of less than £50,000.

For companies with profits of between £50,000 and £250,000 a ‘marginal relief’ will apply, meaning the full 25% rate comes in gradually. Effectively a marginal rate of tax of 26.5% will exist on profits between £50,000 and £250,000, bringing up the overall rate from 19% to 25%.

For trading years straddling the 1st April 2023, profits will be proportioned between 2022/23 rates (flat 19%) and the above 2023/24 regime.

Salary vs Dividends – marginal effective tax rates

The reversal of rises in NICs and the increase in corporation tax (for firms with profits over £50k) tilts things away from dividends and towards salary / bonus.

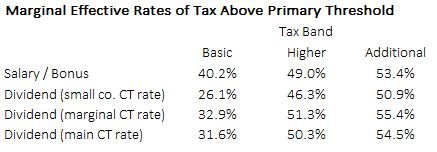

The changes have virtually equalised the effective rate of tax between salary and dividends at higher and additional rates. Dividends remain noticeably more tax efficient at the basic rate however.

For many small business owners, it will remain attractive to continue taking dividends to enjoy that advantage at the basic rate. N.B. dividends are taxed after other income, so you can’t have dividends taxed at basic rate and salary at higher.

The table below shows the effective rates of tax on a business owner drawing £1 of trading profit personally. The rates are at the margin, on each additional £1 drawn within the respective tax bands. It includes the impact of Income Tax, NICs (personal and employer) and Corporation Tax. The rates are those applicable above the primary threshold and dividend allowance (assuming these are drawn first). Dividends are considered for the three potential marginal rates of Corporation Tax (19% small rate, 26.5% marginal rate and 25% main rate).

Important note: the above table considers the three listed taxes only and is based on drawing current year trading profits. It doesn’t consider any other sources of personal income and doesn’t include the potential loss of any benefits or allowances as the result of increased income.

Remuneration Planning 2023/24

For a business owner-manager drawing a salary, the first £9,100 will be completely tax free. Salaries are deductible for Corporation Tax and the amount is below the thresholds for income tax and employer and employee NICs.

Salary above £9,100 will attract employer NICs at 13.8%. Earnings over £12,570, will incur both personal and employer NICs.

For most, it will make sense to draw a salary of £12,570 in 2023/24 – the personal allowance for income tax and point at which you start paying personal NICs. This will involve paying some employer NICs (on salary between £9,100 and £12,570), however employer NICs are lower than corporation tax (for which dividends aren’t deductible).

Above this amount it will usually be more tax efficient to pay dividends, rather than salary. As the above table shows, the effective rate of tax on drawing dividends at basic rate tax is 26% to 33% (depending on Corporation Tax), compared to 40% for salary/bonus.

Once earnings exceed the basic rate, the tax on dividends increases sharply. The basic rate tax band is £37,700, meaning that income can total £50,270 before higher rate tax is incurred (i.e. £37,700 plus the £12,570 personal allowance).

It will also be worth keeping in mind the loss of personal allowance on (total) income over £100k; due to the high effective rates of tax on income between £100k and £125,170.

Below are two examples of a remuneration plan for a business owner. We have assumed that the business makes a profit of over £250k after director remuneration, meaning the main (25%) rate of corporation tax applies:

Example of business owner drawings within basic rate*:

Example of business owner drawings to retain personal allowance*:

* Assuming no other income

Of course, if a husband and wife jointly own and run a business, the above would apply to each. With a 50-50 owned business, c. £126k of trading profits could be used to provide a net income of c. £94k (£47k each) or c. £260k of trading profits could be used to provide a net income of £160k (£80k each).

Employer Pension Contributions

Pension contributions can be very effective for profit extraction, particularly where a business owner is already drawing £100k of income. By making employer pension contributions, funds can be moved into your personal name with no initial tax liability – either personally or on the company (1) – and into an environment which is Inheritance Tax free (2).

Income tax would be incurred when (if) funds are ultimately drawn from a pension, however a.) currently 25% of a pension can be drawn tax-free and b.) income often drops in retirement, meaning income tax incurred is lower than that avoided on making the contribution. Pension allowances have recently been increased.

If you would like more detailed information on contributing to pensions, please see our Business Owner’s Guide to Pension Funding.

Electric Company Cars

Zero emission company cars currently benefit from a generous tax regime (and conventional petrol and diesel cars a terrible one).

For this tax year and next the Benefit in Kind (BIK) rate is just 2% of the list price, meaning if your company provided you with a £50k electric company car, you would be assessed as only having an extra £1k of taxable earnings. From the company’s perspective, 100% of the cost of purchasing a new electric car can be claimed against profits in the first year.

This can make your company providing you with an electric car, rather than you personally buying/leasing a car out of net income a tax efficient option.

If you would like to further discuss remuneration and profit extraction from your business, please do get in touch and we will see if we can help.

1.) assuming the contribution can be justified as part of the remuneration package, which is usually the case for business owner-directors.

2.) for death benefits paid within 2 years of death.

Disclaimer

The above is provided for general information only. No action should be taken without seeking advice for your specific circumstances. Collingbourne Wealth Management does not provide tax advice. All information is based on our understanding of current tax rules as at the time of writing, which can is subject to change.

Image Source: Unsplash