Retirement Planning Winchester

Expert planning for one of the biggest journeys of your life

Retirement is often the biggest single change in life a person undertakes; it can impact almost everything. The impact it has on your time and what you do with it can be just as crucial as the financial implications. Getting it right can make a difference for decades. Given its importance, it is certainly worthwhile considering some advanced planning – and not just on the financial side.

Throughout your working life you rely on your ‘human’ capital, through which your earn money and these earnings are used to cover pretty much everything; they pay for your day-to-day expenditure, they pay-off debts (mortgages in particular) and hopefully they allow you to save for the future.

Upon retirement this earnings tap is (partially or fully) turned off. Now your financial capital has to do the heavy lifting and you will be relying on this for the rest of your life – the key question for most being, how much is enough?

Your Life in Retirement

What do you want your life to look like in retirement? It may sound a little glib, but ultimately, it’s what everything comes down to.

You need to start with what you want to do, how you want to occupy yourself when you are no longer working. Think of day-to-day life; the hobbies and interests you wish to pursue, any community or charitable projects you wish to undertake or any ongoing work (e.g. consultancy) as well as the big-ticket items like to travel and holidays or new cars, boats etc.

Once you’ve started defining what you want your life to look like, you can start to think about what that lifestyle is going to cost. Of course, not all your dreams and aspirations may be attainable, but you can start to think in terms of must-haves, nice-to-haves and priorities.

In helping our clients navigate these issues we have three main roles:

Lifestyle Planning

Financial Planning

Wealth Management

Through the first of these roles we help clients explore what they and their partner want their lives to look like. Few clients have ever sat down and thought about this is in detail, let alone discussed and agreed it with their partner.

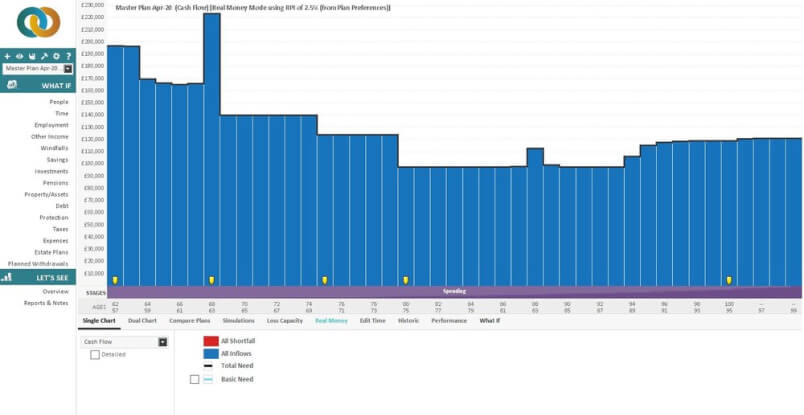

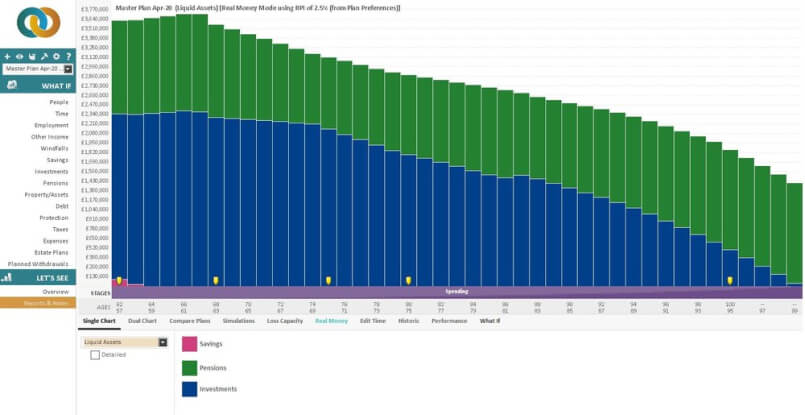

Through our second role as Financial Planners we can quantify what these life plans will cost and how they can be funded. We can explore the long-term financial impacts of different decisions, the various options and trade-offs available and let people see what is likely possible. This allows people to make informed decisions, to live the best lives they can and be confident their future has been planned out and their financial lives are secure.

Only then can we consider the execution of those plans through wealth management services

Already retired?

Not all our clients come to us whilst still planning their retirement, some are already there. Many of the issues and questions remain the same.

Are you making the most of your retirement? Is there more you wish you could do – could you afford to spend more to achieve this? Have you wanted to help children or close family members during your life but been unsure whether you are in the financial position to do so?

For some it may be a concern over sustainability of spending and future financial security. Are you confident you have enough financial resources to maintain your lifestyle for the rest of your life?

By going through these lifestyle and financial planning processes we can help answer these questions, so you know you are making the most of your resources to achieve what is important to you.

Business Owners Guide to Pension Funding

Are you an SME business owner or an executive of an SME and want to know more about pension funding? Join our mailing list and receive a free copy of our Business Owners Guide to Pension Funding.

Business Owners Guide to Pension Withdrawal

Are you an SME business owner or an executive of an SME and want to know more about pension funding? Join our mailing list and receive a free copy of our Business Owners Guide to Pension Funding.

Financial Independence

What is financial independence? It is being in a position where you are no longer reliant on your earnings; you could afford to fund your desired lifestyle for the rest of your life without ever having to earn again.

It is an important aim of retirement planning – once achieved you are in a position to retire should you wish. For many however it is separate from their plans to retire.

Having financial independence gives people freedom and flexibility. They know they don’t have to work if they don’t want. They know they can find another role or do things other than work if they want. They can go into work / run their business because they chose to.

Achieving financial independence can often provide a clarifying moment for clients. They can often view their work / business in a different light once achieved, allowing them to really focus on what they do and do not want in life.

Being financially independent also provides security and protection. If someone were to lose their job or their business was to suffer, or they could no longer work due to serious illness, their finances are already in a position to cope with that.

What is a Pension?

What is financial independence? It is being in a position where you are no longer reliant on your earnings; you could afford to fund your desired lifestyle for the rest of your life without ever having to earn again.

It is an important aim of retirement planning – once achieved you are in a position to retire should you wish. For many however it is separate from their plans to retire.

Having financial independence gives people freedom and flexibility. They know they don’t have to work if they don’t want. They know they can find another role or do things other than work if they want. They can go into work / run their business because they chose to.

Achieving financial independence can often provide a clarifying moment for clients. They can often view their work / business in a different light once achieved, allowing them to really focus on what they do and do not want in life.

Being financially independent also provides security and protection. If someone were to lose their job or their business was to suffer, or they could no longer work due to serious illness, their finances are already in a position to cope with that.

Pensions can be a powerful tool in achieving financial aims; they can form important parts of tax and estate planning, as well as retirement planning. Whilst the concept of a pension maybe relatively straight forwards, getting the most out of their planning potential can be a challenge – a fact that has not been helped by continual tinkering and rule changes by successive governments.

Clients often come to requiring help in managing their pensions in the following areas:

- Funding – how much can/should I contribute?

- Remuneration / Tax Planning

- Withdrawal – how much should I withdraw from my pension and how?

- Income / Tax Planning

- Annual Allowance & Lifetime Allowance limits and charges

- Investment Management

- Death Benefits – who will get my pension, in what form and how will it be taxed?

- Estate Planning

Book a consultation

with Martin Strutt.

Talk to our Financial Planners about how to improve and plan for your financial future. Our Financial Planners:

- Put the client first – in our office when we discuss a particular issue for a client the most clarifying question we ask is “if we were the client what would we do in this situation?”

- Fierce independence – our only criteria for working with service providers and other professionals is that they deliver great solutions for our clients at a competitive price (even when at some inconvenience to ourselves)

Have a question about financial planning?

Use this form to send us a message or use the button to book a free Zoom meeting.