A look under the bonnet of equity investing

We hear a lot about stock markets in the news, usually along the lines of “billions wiped off global stock markets”, ‘company X’s shares skyrocket’, ‘company y’s crash’, ‘this is all due to - insert latest perceived wisdom here’.

We don’t tend to hear much detail or nuanced discussion around markets / company shares from these sources. In this blog we thought we’d provide a little insight into the different ‘styles’ of equities.

What do you mean equity styles?

As you can imagine given the amounts of money involved, there has been a huge amount of research over the years into what drives equity (shares) returns. Broadly it is the expectations of future company earnings, which is of course affected by a great number of things. The greater the uncertainty / risk in these earnings expectations, the greater the return that will be demanded by investors for taking that risk.

Company accounts have a lot of information – giving various metrics, ratios etc - which impacts its share price. Research usually focuses on which elements are driving share prices and returns. As investors demand higher returns for accepting more risk, this tends to entail looking for ‘risk factors’.

There have been numerous possible ‘factors’ of equity returns highlighted. I am just going to mention the two most famous of them and dig a little deeper into one which is particularly interesting at the moment.

The first highlighted factor (after equity market risk itself) was company size. Little companies are more risky than big companies and as such, investors tend to demand a higher rate of return to hold them. An investor’s return is the company’s cost of capital (they’re opposite sides of the same coin) and we would expect a small company to pay more to raise capital than a safer, larger firm. This makes intuitive sense and can been seen over decades of market data.

The second factor, which we’ll discuss in detail now, is ‘value’ shares and their opposite; ‘growth’ shares. Value shares are broadly those that have a low price relative to various metrics, such as shareholder equity, or earnings, whereas growth shares are those with higher prices.

Investors are more pessimistic about the futue of value companies and more optimistic about growth companies. A good example of a growth company is Tesla, which became the world’s most valuable car manufacturer a while ago, despite not making that many cars or much profit (at the time of writing)– investors are expecting that to arrive at high levels in the future. Growth companies are named as such because they need to grow (sales, profits) to justify their share price.

Over the past decade following the financial crisis and the associated fallout (litigation, regulation and low interest rates), most major banks are value companies - investors are expecting them comparatively to struggle to increase profits and grow in the future.

Aren’t growth companies better then?

Well, for an investor not necessarily. Remember an investor’s return is the company’s cost of capital and investors are going to accept lower returns from good ‘safer’ companies and demand higher returns from riskier ones.

This is what we have seen over decades of market data. Over the long-term, value shares have tended to deliver higher returns. This is true across different stock markets over different time periods. The chart below shows the returns of ‘value’ shares relative to broader stock market returns in different regions:

Data Source from Dimensional Returns Programme: UK (07/1955 to 02/2019) – Dimensional UK Marketwide Value Index, FTSE All Share Index; US (02/1955 to 02/2019) – Dimensional US Marketwide Value Index, Dimensional US Market Index; Global (02/1975 to 02/2019) – Dimensional Global Large Value Index, MSCI World Index (net div.).

However, value shares don’t always deliver higher returns. This logically has to be true, as otherwise they wouldn’t be any riskier and investors wouldn’t get compensated with any extra return. Value shares do periodically deliver lower returns and they can do so for sustained periods – just like small companies can periodically underperform larger ones.

The chart below (US data) shows the proportion of time that the equity ‘Market’ as a whole underperforms cash and that value companies and small companies respectively underperform the stock market as a whole. The proportions are shown for 1, 5- and 10-year long investment holding periods.

Source: Dimensional. Steiman, B., Dai, W. (April 2019). “Perspective on premiums”. Percentage of rolling 1-, 5-, and 10-year periods with negative premiums is calculated using monthly return data from 06/1927 – 12/2018.

The chart shows that US equity markets as a whole have delivered returns below cash in around 3 years in 10. If you invested for a 5-year period, you would have had roughly a 1 in 5 chance (21%) of being worse off (than holding cash) and if you had invested for 10 years, your odds of being worse off were around 1 in 7 (15%). We can see, value shares underperform about the same amount of time (just a little bit more) than as equities underperform cash – with a 1 in 4 chance of underperforming over a 5-year period and roughly a 1 in 6 chance (16%) over 10 years.

The good news is that value shares don’t necessarily under or outperform at the same time that equity markets are rising or falling. So, although the value shares are riskier themselves, you can include them (or rather a greater amount of them) and increase the expected return on your portfolio, without dramatically increasing the risk of your portfolio as a whole.

So, are value shares outperforming now?

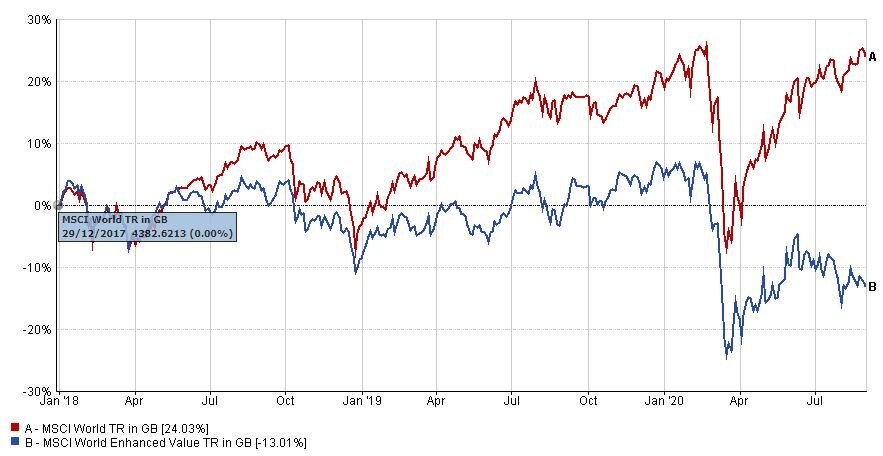

No, not at all. Over the past two years we have seen one of the worst performances of value shares that we have ever seen, and this includes data going all the way back to 1927 in the US. Investors who have been holding value stocks (or above average amounts of them) have seen their portfolios suffer recently. We are firmly in the 16% of outcomes from the chart above where value shares have underperformed over a 10-year period.

Data sourced from Financial Express Analytics; 31/12/2017 – 31/08/2020

This has led to many investors questioning whether they should hold value shares at all and whether the value ‘premium’ is dead. A range of possible reaons have been proposed, all essentially saying value investing doesn’t work in the modern 21st century world, either because in our globalised economy a few giant companies will dominate, or that tech companies will now dominate (which tend to be predominantly growth companies and as you’re probably aware have done very well this year e.g. Zoom, Amazon etc).

We have questioned this ourselves. We always need to review new evidence and challenge our assumptions to ensure our portfolios remain as efficient as possible. So, do we believe the value premium is now dead? Have our fundamental views of the investment theory and historical evidence changed over the last 2 years?

We don’t believe the basic tenet of value shares being a risk factor has changed. The investor’s return remains the company’s cost of capital, and we would expect that to be higher for riskier value stocks than successful growth stocks. Evidence has shown (particularly in the US, where more data is available) that value stocks have underperformed heavily before and then recovered. This isn’t something entirely new, even if the scale is dramatic.

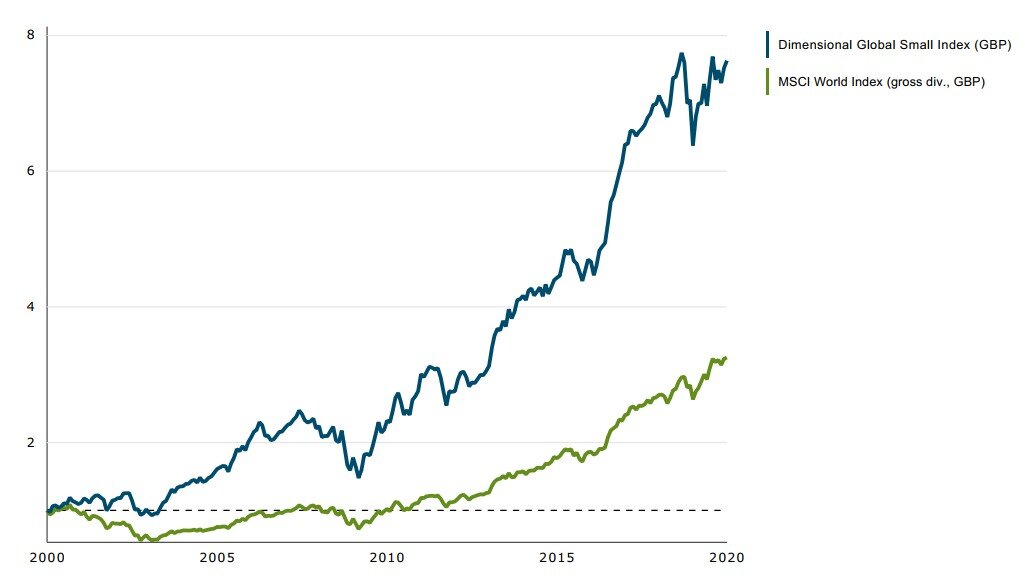

We also know from more recent experience that this isn’t the first risk factor to be questioned. Small company shares underperformed large company shares significantly throughout the 1990’s, leading to similar calls that the small company ‘premium’ was dead and didn’t work in today’s globalised economy. Over the subsequent 20 years, small companies have delivered very large additional returns, which would have been badly missed by those who called the premature death of small company investing.

Data sourced from Dimensional Returns Programme, 01/1995 – 12/1999

Data sourced from Dimensional Returns Programme, 01/2000 – 12/2019

Global small companies are the green line in the first chart and blue in the second!

There has also recently been further academic research into the subject. A paper (1.) was produced in March which aimed to assess whether there was a plausible explanation of value’s underperformance and whether the premium was indeed dead in today’s world. They examined the premium in a number of different ways (using different accounting measures) and assessed many of the different reasons given for its demise i.e. globalisation, dominance of technology*, or of a few mega winning companies (amazon, google …) etc.

The results showed that no matter the explanation offered, whatever the mitigation offered, value company shares are currently pretty much as cheap as they ever have been. Even discounting the largest firms or the tech industry (amongst others), value stocks are still lower in relative price than they ever have been. They found no reason to assume the value premium was indeed dead.

* although value investing has worked since the 1920’s and we’ve hardly had technological stand still since then!

Concluding Comments

We do not know when value stocks will outperform again (or even be absolutely certain that they will). We do however think that on the balance of probability value stocks will deliver higher returns again at some point – both as a result of theory and evidence. Our fundamental view of the investment world has not been changed by the past two years; we always knew there was a perfectly good chance of it happening at some point.

We know that value shares have underperformed before and when they have recovered, they have often done so very quickly and very sharply. We also know that value shares are currently priced as cheaply as they ever have been compared to growth shares. Again, we don’t that value shares definitely will outperform, or if they do, when. But we strongly believe that on the balance of probabilities, they are a risk factor worth taking.

(1.) “Is (Systematic) Value Investing Dead?” - Ronen Israel, Kristoffer Laursen, Scott A. Richardson

Disclaimer:

Data in Total Returns, all income reinvested, GBP terms. Returns are based on market indices, representing individual asset classes, a full list of which can be provided on request. Indices are not available for direct investment and take no account of any costs or individual tax liabilities, that must be occurred when investing, which reduce net returns. These figures are provided for information purposes only.

This document should not be considered a recommendation to purchase or sell any particular investment. Care has been taken to ensure the accuracy of content, but no responsibility is accepted for any errors or omissions. We do not predict or guarantee the future performance of any individual security, investment, portfolio or asset class.

Categories / Topics

Latest / Recent Posts