When it comes to investments, as with everything, we start with “Why?”.

Any investment you make should start with the end in mind and be integrated with your wider planning. Your investment plan is the ‘engine’ which will drive your financial life, however you need to start with planning the journey you want to take (your Lifestyle Plan) and deciding what vehicle you will use (your Financial Plan), before you begin building the engine.

Evidence-Based Investing

To safeguard and grow your wealth, we make investments based on evidence, not hope or guesswork.

Our investment process is based on the insights provided by leading, Nobel-prize winning academic theory and the evidence provided by decades of market data. We ignore the conventional wisdom and the noise generated by a self-serving investment industry and a media looking for a story to sell; we focus on what is important AND what can be controlled.

We have been investing through a systematic, evidence-based process for over 15 years, over which time our clients have enjoyed a highly successful experience. When we began, we were outliers, now our way of investing is the norm for institutional investors around the world.

We are founding members of Evidence Based Investment Solutions (EBIS), a group of highly qualified, like-minded investment professionals. EBIS allows us to pool resources; combining in house research with external consultants to keep our strategies at the forefront of leading investment thinking.

Investment Principles

Our evidence-based approach focusses on the following 6 principles;

Risk and Return are Related

You cannot gain a higher expected return without taking additional risk (you can of course obtain risk without expected return).

Any rate of return you receive is being paid by someone else. As Nobel Laureate Eugene Fama frames it: “the investor’s return is the company’s cost of capital” – they are the opposite sides of the same coin.

If an investment is low risk, it would only need to offer a low rate of return to attract capital - it wouldn’t need to offer high returns. If high returns are being offered, there must be a reason. If something seems too good to be true, it probably is.

Set a ‘Risk Budget’

If you accept you cannot obtain an expected return (beyond cash) without accepting investment risk, then deciding how much risk to take has to be the most important decision to make. This should always be viewed within the context of your wider financial planning.

There are three key elements to consider when making this decision:

Emotional Tolerance: How much risk could you cope with?

Financial Capacity: How much risk can you afford to take?

Return Requirement: What return do you need?

It is a decision that most investors fail to get right themselves, taking on too much or too little risk, which can have severe consequences, particularly during times of market turbulence. At Collingbourne we have a proven process and tools to help you answer this crucial question.

Set an Efficient Asset Allocation

Having set your Risk Budget, it needs to be used wisely. An efficient investment process should aim to maximise returns for each unit of risk you have chosen to take.

This requires on focussing on what truly drives investment risk and returns. Academic theory and decades of market evidence point to different factors of returns in equities and fixed income (bond) investments. We capture these building blocks of risk and return and use them to construct efficient portfolios.

Discipline

We all, professionals included, struggle to separate our emotions from investment decisions. This works against us in the counter-intuitive world of investing.

Investors tend to go through an emotional cycle; optimism reigns as markets rise, leading to elation at their highs, giving way to nervousness as markets fall and fear at their lows. Everyone has heard of buy low, sell high, but their emotions lead to them doing the opposite.

This has happened for hundreds of years; we’ve seen it documented as early as the Dutch tulip bubble in the 17th century (counting casualties such as Isaac Newton). The most damage is done at market extremes, particularly selling out during a market crash.

This is the main reason why almost all investors underperform markets and suffer poor returns. The only solution to this is to have a rigorous and disciplined investment process.

Diversify

“the only free lunch in finance” - Harry Markowitz, Nobel Laureate.

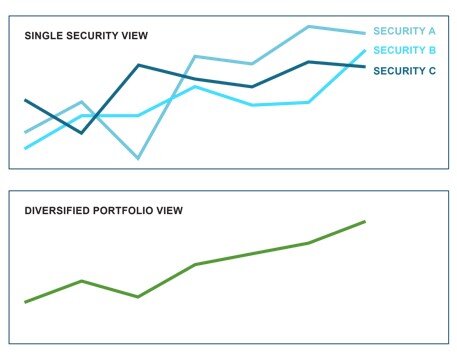

Essentially this means spreading your investments across a number of holdings. Broadly speaking, adding more holdings to your portfolio improves your return for a given level of risk, or reduces your risk for a given level of return.

Diversification can be harnessed at multiple layers of portfolio construction to mitigate risks and improve portfolio efficiency. It can remove concentrations of risk and help ensure your portfolio is not dependent on the results of any individual holdings, companies or sectors.

Control Costs & Tax

Put simply every £1 of cost or tax is £1 off your net return. It sounds obvious, but costs should only be incurred where the expected return is greater than the cost. However, that is not always the case.

People often believe that you get what you pay for. However, evidence shows that with investing, you tend to get what you don’t pay for. Over the long term the better performing funds, tend to be the lower cost ones.

By integrating your Investment Plan within your Financial Plan, you can also minimise tax losses throughout life, improving net returns.

Book a 15 minute consultation with Martin Strutt.

Talk to our Financial Planners about how to improve and plan for your financial future. Our Financial Planners:

Put the client first – in our office when we discuss a particular issue for a client the most clarifying question we ask is “if we were the client what would we do in this situation?”

Fierce independence – our only criteria for working with service providers and other professionals is that they deliver great solutions for our clients at a competitive price (even when at some inconvenience to ourselves)